Ethereum: Post-Merge Looking Forward

Summary:

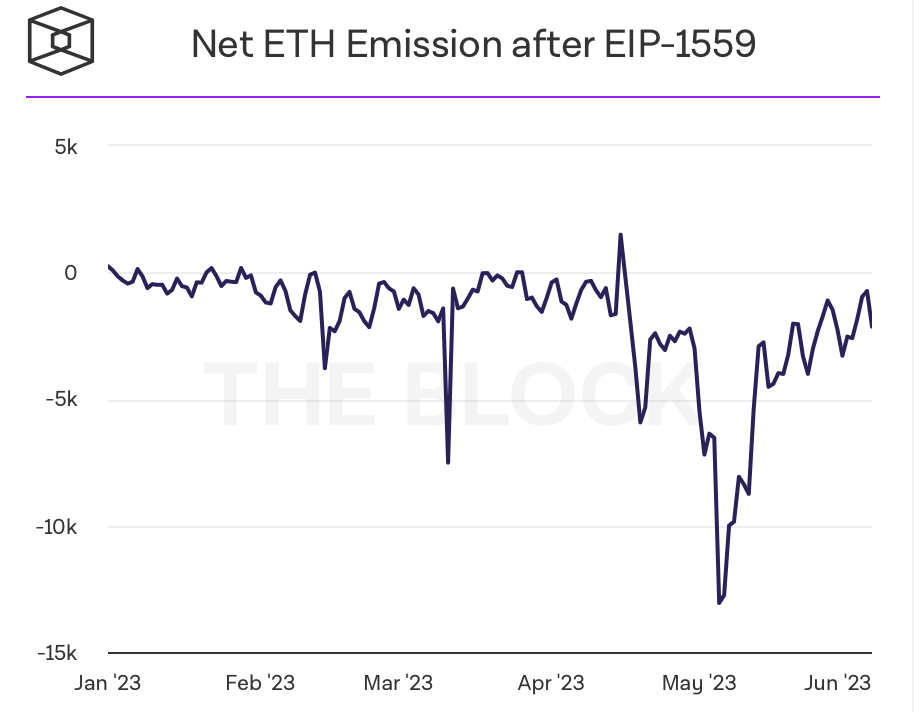

The London (EIP-1599) and Merge in Ethereum have resulted in net deflationary token issuance, where the rate of token burning exceeds the rate of token creation.

During periods of heightened chain activity, net deflationary issuance accelerates.

Reading time: 3-4 minutes

From London With Love

The implementation of the London upgrade EIP-1599 and the subsequent Merge upgrade in Ethereum have brought about significant changes to the network. Prior to these updates, Ethereum operated on a proof-of-work (PoW) consensus mechanism, where new Ether tokens were minted as a reward for miners who validated transactions. However, with EIP-1599 and the Merge, Ethereum has transitioned to a proof-of-stake (PoS) consensus mechanism. Under PoS, new Ether issuance has become deflationary, meaning that the rate of token creation is now slower than the rate of tokens being burned. In fact there are 280,000 less ETH in existence today than at the beginning of the year.

Mining and Staking

Before the upgrades, Ethereum was mined using a proof-of-work algorithm. The below chart represents pre-merge validator (miner) revenue vs post-merge validator (staker) revenue.

Source: The Block

Next Cycle Problems and Opportunities

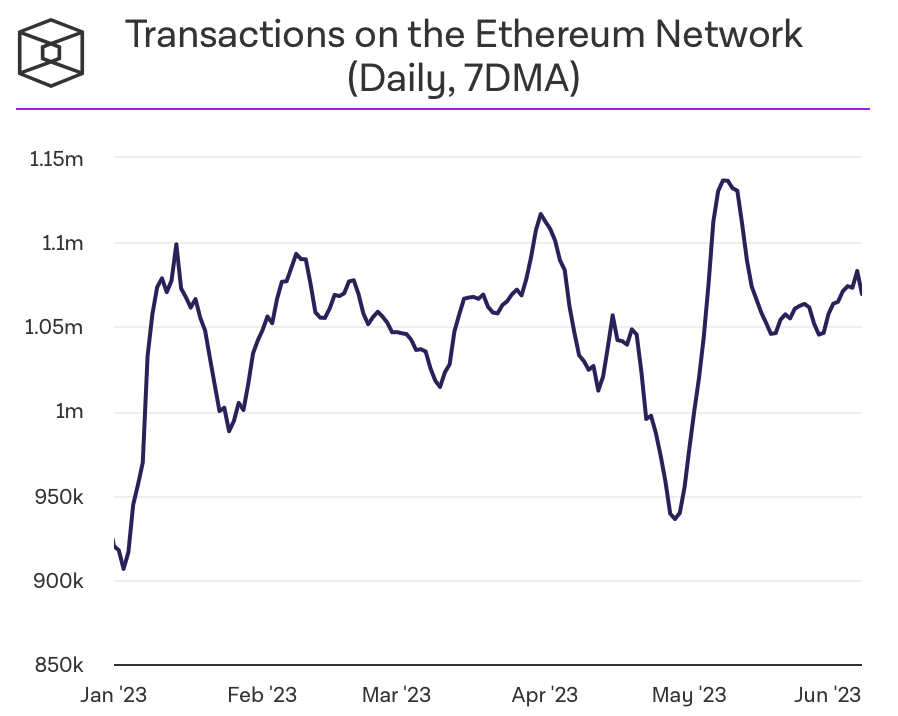

The London Upgrade insured that transaction fees would be burned instead of directed to the network’s miners. The below charts depict a rise of transactions and coinciding drop fo net issuance of ETH peaking in late May of this year. This episode provides a glimpse of the potential for a dramatic swing during the next bull market in activity.

Source: The Block

Source: The Block

It is increasingly clear that Ethereum will experience accelerating deflationary net issuance as activity and transaction demand pick up during a bull market move. This will be the first iteration of deflationary issuance coupled with a risk on environment in the nascent history of digital assets.

Given the unique supply and demand aspects of ETH, the current 60%-65% implied volatility of ETH options would seem to discount very little in the way of an anomalous price move. Yet the outliers are often mispriced.

If you enjoyed our newsletter, please forward to a friend and subscribe.

Follow us on Twitter for updates.

Disclaimer: QCI Partners Inc. (‘QCI”) is a state registered investment adviser. Any direct communication by QCI with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, QCI makes no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to QCI. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. QCI accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither QCI nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions, forecasts or projections contained in this material represent QCI’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/orbe affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. QCI may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and QCI is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within QCI may take views that are inconsistent with those taken in this material. Employees of QCI not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.